The Inside Income Service (IRS) is a vital part of the US authorities, liable for gathering taxes and imposing tax legal guidelines. The company’s major purpose is to make sure that people and companies adjust to tax laws, thereby producing income for the federal government. To realize this goal, the IRS employs a staff of auditors, directors, and inspectors who work tirelessly to evaluate monetary paperwork, establish discrepancies, and make suggestions for enchancment.

On the coronary heart of the IRS’s auditing course of is the idea of verification. Auditors meticulously look at monetary data, tax returns, and different documentation to make sure that they precisely mirror a person’s or enterprise’s revenue, bills, and tax obligations. This includes an intensive evaluate of monetary statements, together with stability sheets, revenue statements, and money circulation statements. By analyzing these paperwork, auditors can establish potential errors, omissions, or discrepancies which will impression a person’s or enterprise’s tax legal responsibility.

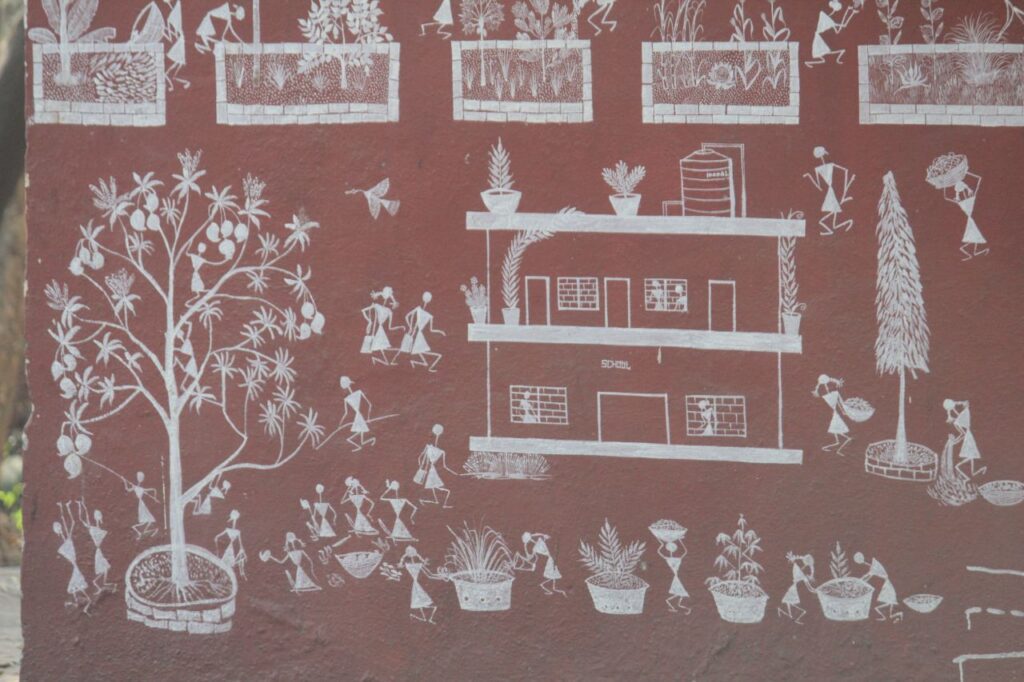

Within the picture, we see an administrator, a enterprise man, and a secretary working collectively to make a report and calculate the stability. The administrator is probably going a senior official inside the IRS, liable for overseeing the auditing course of and guaranteeing that it’s carried out in a good and neutral method. The enterprise man, then again, is probably going a consultant of an organization or particular person being audited, who’s working intently with the IRS to resolve any discrepancies or points which were recognized. The secretary, in the meantime, is probably going a help employees member who’s liable for getting ready paperwork, taking notes, and offering administrative help to the auditing staff.

The IRS’s auditing course of is a vital part of its general mission to make sure tax compliance. By conducting common audits, the company can establish areas the place people and companies could also be underpaying or overpaying taxes, and make suggestions for enchancment. This not solely helps to generate income for the federal government, but in addition ensures that the tax system is honest and equitable for all residents.

Along with verifying monetary info, the IRS’s auditing course of additionally includes figuring out and addressing potential tax evasion or avoidance schemes. This will likely contain reviewing complicated monetary transactions, comparable to these involving offshore accounts or shell corporations, to find out whether or not they’re reliable or half of a bigger scheme to evade taxes. By taking a proactive method to figuring out and addressing tax evasion, the IRS can assist to stop tax losses and be sure that the tax system is honest and equitable for all.

The IRS’s auditing course of can be an vital instrument for selling tax compliance and training. By working intently with people and companies to resolve any discrepancies or points which were recognized, the company can present precious steerage and help to assist them perceive their tax obligations and be sure that they’re in compliance with tax legal guidelines and laws. This not solely helps to advertise tax compliance, but in addition helps to construct belief and confidence within the tax system.

In conclusion, the IRS’s auditing course of is a vital part of its general mission to make sure tax compliance. By verifying monetary info, figuring out and addressing potential tax evasion or avoidance schemes, and selling tax compliance and training, the company can assist to generate income for the federal government and be sure that the tax system is honest and equitable for all residents. The picture of the administrator, enterprise man, and secretary working collectively to make a report and calculate the stability is a strong reminder of the significance of the IRS’s auditing course of and the vital function that it performs in selling tax compliance and training.