The world of finance is a fancy and ever-evolving panorama, the place the pursuit of wealth, success, and financial progress is on the forefront of each resolution made. On this dynamic atmosphere, companies and people alike should navigate the intricate internet of markets, currencies, and monetary establishments to attain their objectives. The headline “enterprise gold wealth economics success finance market cash forex financial institution banking mortgage monetary economic system trade cash wealthy money revenue make investments euro saving” encapsulates the essence of this multifaceted world, touching upon varied features of the monetary sphere which are essential to understanding and thriving in it.

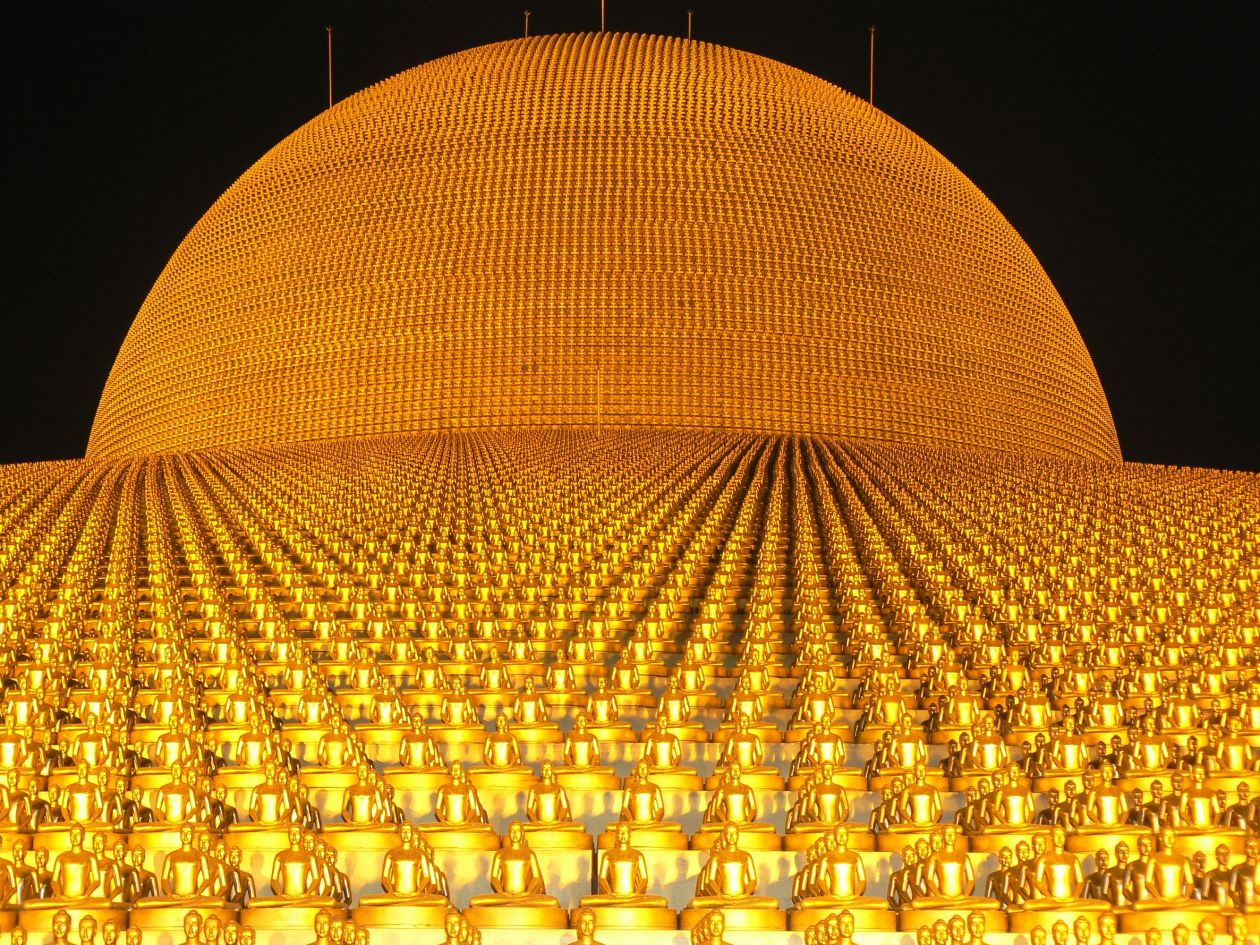

Gold, as a logo of wealth and stability, has been a staple within the monetary world for hundreds of years. Its intrinsic worth and rarity make it a sought-after commodity, typically used as a hedge in opposition to inflation and financial uncertainty. Companies and people alike put money into gold to protect their wealth and guarantee monetary safety.

Economics, the research of how societies allocate assets, performs a significant function in shaping the monetary panorama. It offers the framework for understanding market dynamics, provide and demand, and the components that affect financial progress and stability. A robust economic system is important for companies to thrive, because it creates a good atmosphere for progress, funding, and growth.

Success within the monetary world is commonly measured by one’s potential to generate wealth and obtain monetary independence. This may be completed via varied means, corresponding to beginning a profitable enterprise, investing in shares or actual property, or acquiring a high-paying job. Monetary success additionally requires a deep understanding of the market, a capability to make knowledgeable selections, and a willingness to take calculated dangers.

Finance, as a self-discipline, encompasses the administration of cash, investments, and monetary dangers. It’s the spine of the monetary world, offering the instruments and data obligatory for companies and people to make sound monetary selections. From banking to loans, finance touches each side of our lives, from the smallest transaction to essentially the most important investments.

The market is the lifeblood of the monetary world, the place provide and demand dictate the worth of products and companies. It’s a highly effective power that influences economies, shapes industries, and drives innovation. Understanding the market and its nuances is essential for companies and people wanting to reach the monetary realm.

Forex, within the type of cash and paper cash, is the lifeblood of the worldwide economic system. It facilitates commerce, permits wealth creation, and serves as a retailer of worth. Completely different currencies, such because the euro, symbolize the varied monetary programs and economies of the world. Change charges between currencies fluctuate primarily based on varied components, corresponding to rates of interest, inflation, and geopolitical occasions, impacting companies and people alike.

Banks and different monetary establishments play a essential function within the monetary world, offering companies corresponding to loans, financial savings accounts, and funding alternatives. They facilitate the circulate of cash and assets, enabling companies to develop and people to attain monetary independence.

In conclusion, the headline “enterprise gold wealth economics success finance market cash forex financial institution banking mortgage monetary economic system trade cash wealthy money revenue make investments euro saving” captures the essence of the monetary world, highlighting the significance of understanding and navigating the advanced panorama of markets, currencies, and monetary establishments. By mastering these ideas and making knowledgeable selections, people and companies can obtain monetary success and contribute to a thriving world economic system.