The world of finance is an ever-evolving panorama, the place the worth of cash, foreign money, and the greenback play essential roles in shaping economies and influencing particular person choices. On this complicated system, understanding the nuances of monetary devices, international markets, and financial insurance policies is important for making knowledgeable decisions and staying forward of the curve.

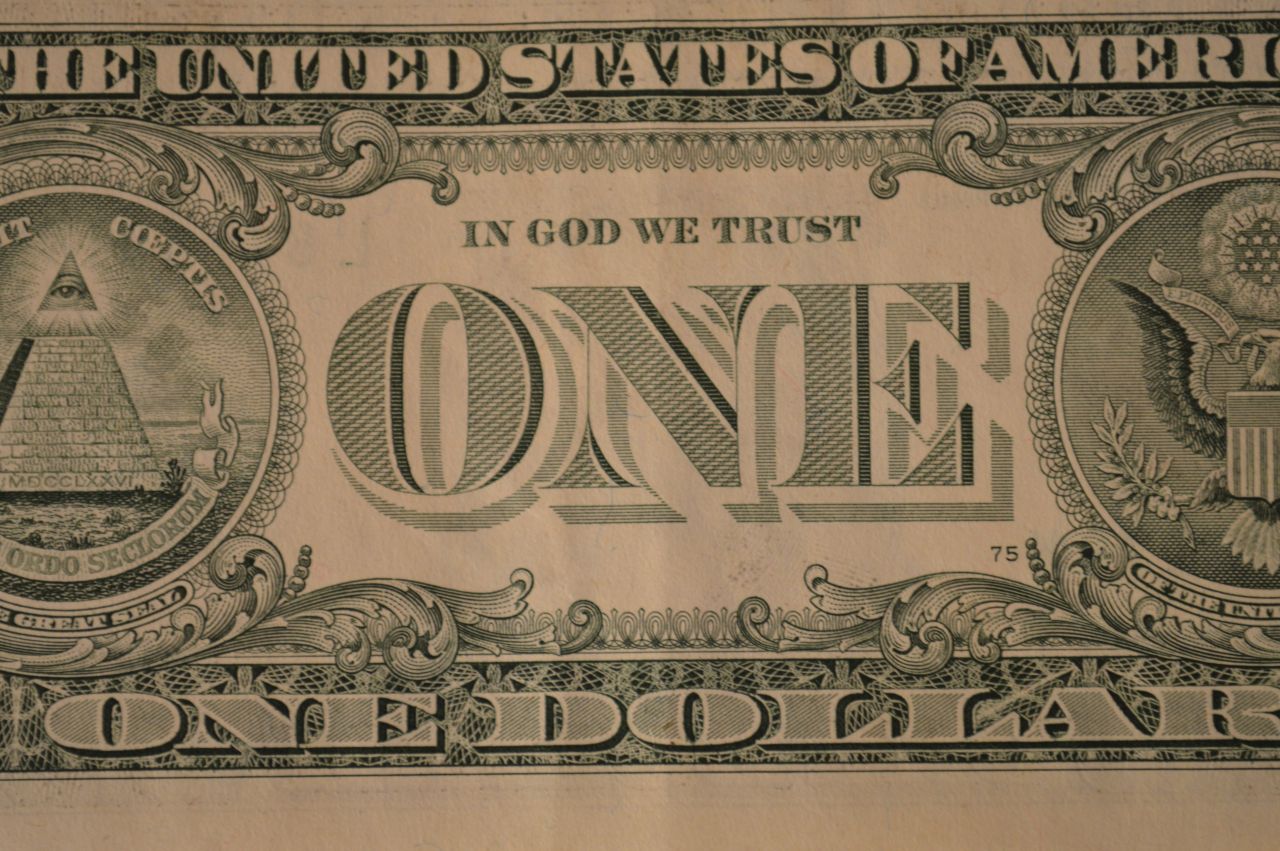

One of the vital important facets of finance is the idea of foreign money. Currencies function mediums of trade, shops of worth, and models of account in varied economies. They’re backed by the religion and confidence of the general public of their skill to take care of their buying energy and stability. Essentially the most extensively used foreign money on the earth is america greenback, which enjoys a powerful popularity as a steady and dependable retailer of worth.

The greenback’s energy might be attributed to a number of elements, together with the dimensions and variety of the US financial system, the nation’s political stability, and the affect of the US Federal Reserve. The Federal Reserve, also known as “the Fed,” is the central banking system of america. It’s liable for implementing financial coverage, supervising and regulating banks, and offering monetary providers to the US authorities.

One of many key instruments the Fed makes use of to handle the financial system is the federal funds fee, which is the rate of interest at which banks lend reserve balances to different banks on an in a single day foundation. By adjusting the federal funds fee, the Fed can affect the availability of cash within the financial system, which in flip impacts inflation, financial progress, and total monetary stability.

Along with the Fed’s affect, international financial elements additionally play a job in shaping the worth of the greenback. For instance, when the US financial system is performing properly and rates of interest are comparatively low, the greenback tends to strengthen as buyers search safer investments. Conversely, throughout occasions of financial uncertainty or when rates of interest are rising, the greenback might weaken as buyers search for extra enticing alternatives elsewhere.

Finance notes additionally spotlight the significance of understanding varied monetary devices, resembling shares, bonds, and derivatives, which can be utilized to handle threat and generate returns. These devices are traded on monetary markets, the place costs are decided by provide and demand, and investor sentiment.

In conclusion, the world of finance is a posh and interconnected system, the place the worth of cash, foreign money, and the greenback play crucial roles in shaping economies and influencing particular person choices. By understanding the nuances of monetary devices, international markets, and financial insurance policies, people and establishments could make knowledgeable decisions and navigate the ever-evolving monetary panorama with larger confidence.